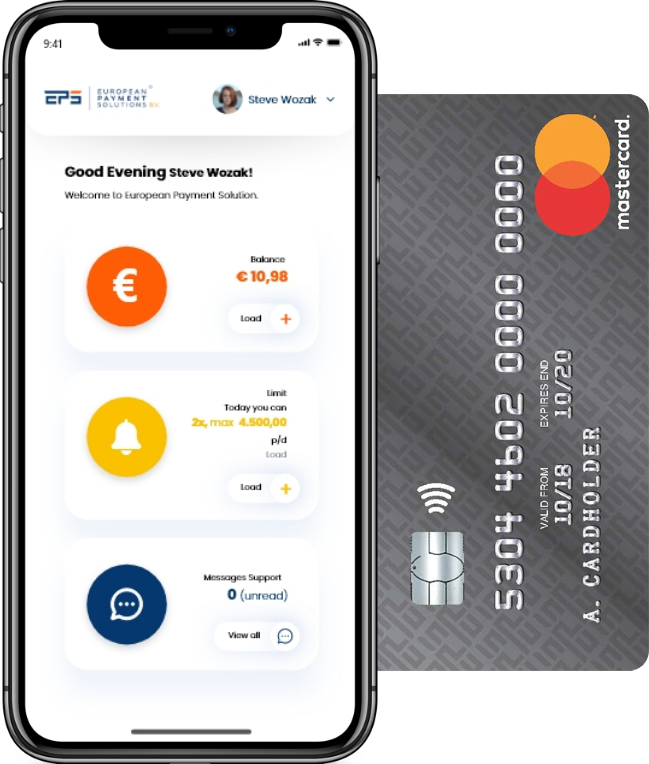

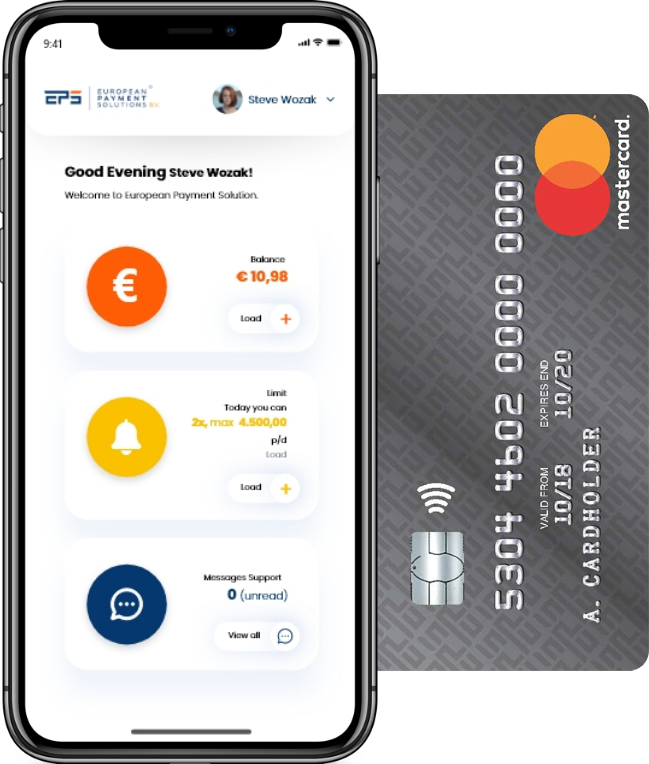

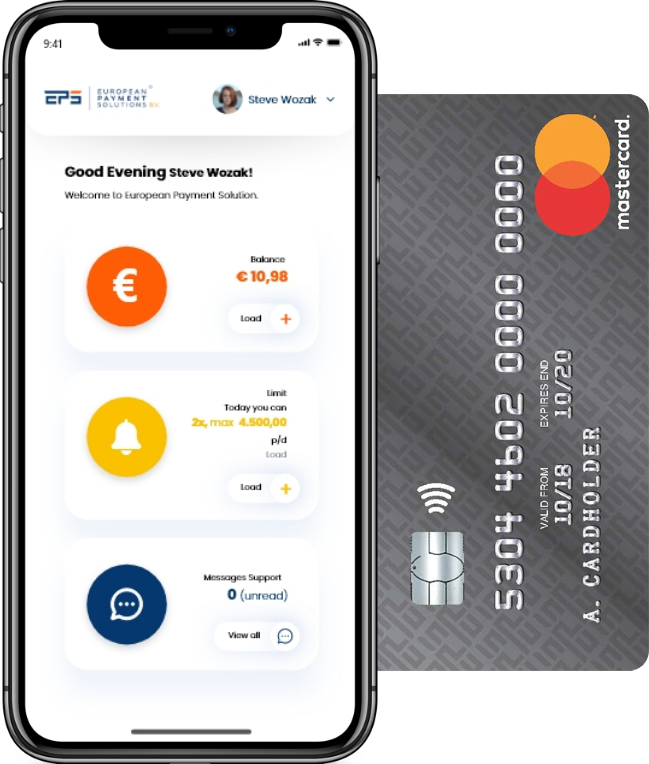

Handle your money, your way with

EPS MASTERCARD

The financial solution for your business expenses.

The easiest financial solution for both business and private individuals

Handle your money, your way with

EPS MASTERCARD

The financial solution for your business expenses.

The easiest financial solution for both business and private individuals

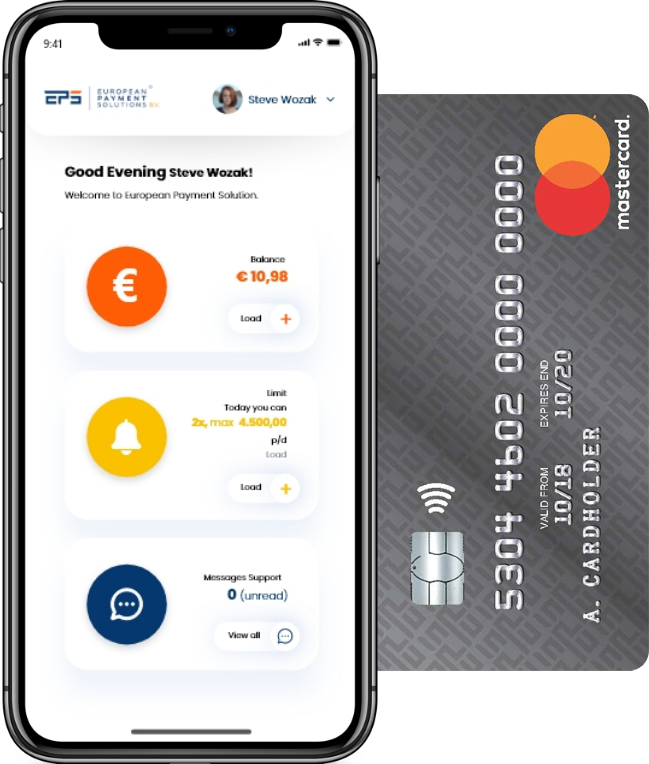

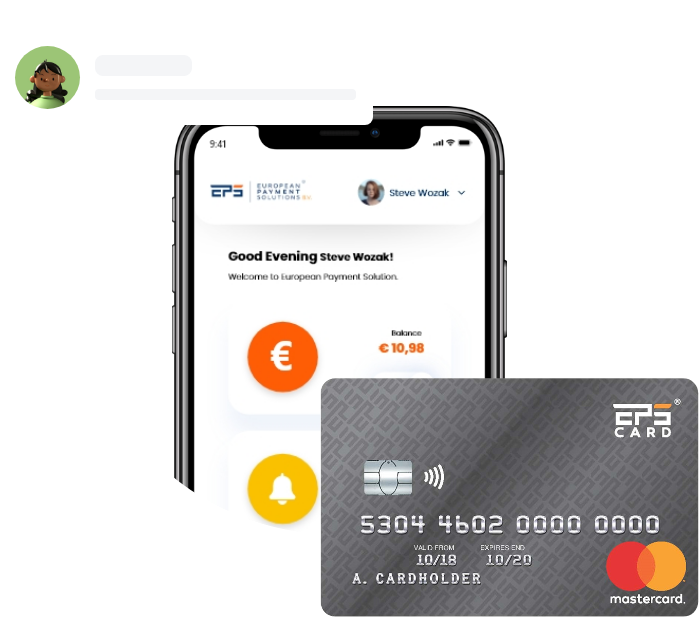

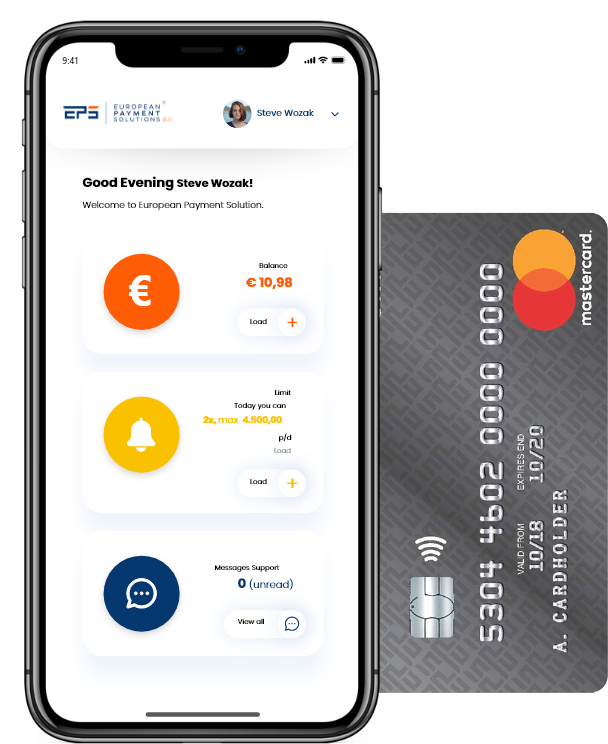

Use it. Reload it. Love it.

A card with the same functions as a credit card with one big difference: you load the balance on the card beforehand.

The EPS Card is a rechargeable prepaid Mastercard for business use. There is one important difference with a normal credit card, you charge the card before use.

This has many advantages: you do not take out credit, you do not have to pay interest and you can only spend what you have charged.

In exceptional situations it may happen that a negative balance arises. E.g. the amount you have to pay to the hotel is higher than what has been booked or an exchange rate has changed, in which case you must immediately top up the negative balance. See article 3.6-3.8 of the General Terms and Conditions or the FAQ under the heading "Usage" under "Negative Balance" for more information. Read more

Do you want to purchase more than 10 cards? Or are you interested in our EPS Card Prepaid Mastercard, but do you have specific wishes?

Depending on the size of your company, European Payment Solutions offers you various solutions to make the management of your card (s) as easy as possible.

Win the hearts of customers and create a tangible distinctive character from your competitors!

EPS Cards printed with your company name or logo are a great branding opportunity for your business.

Are you in online Marketing, do you specialize in Facebook advertising or Adwords?

European Payment Solutions understands the importance of continuity in your campaigns. We also understand that you want to keep an overview when using multiple prepaid Mastercards.

Below you will find an overview of the prices and limits for the EPS Business Card.

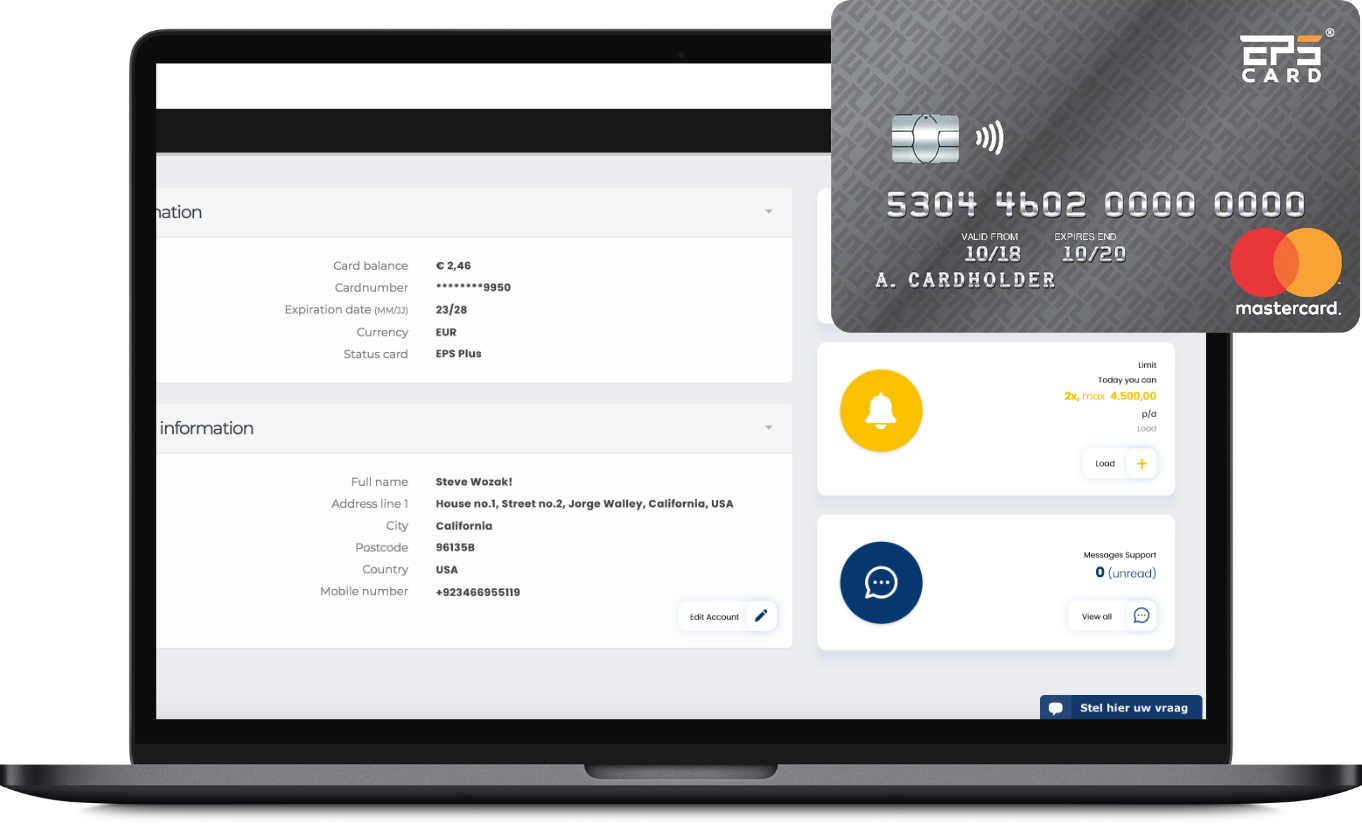

The EPS Card is valid for three years.

The EPS Prepaid Mastercard® works like a regular Mastercard. With one difference: you load the balance on the card yourself in advance. This way you always keep a grip on your money.

Do you have a basic card and want to be able to do more with your card? Then upgrade your card. Log into your account, click on "Upgrade my card" in the left menu. We check your ID and address and then you can use all the benefits of a plus card!